I’m a huge fan of the original Dr. Mario on NES. I suspect it’s the best classic puzzle game of all-time. I’ve beaten level 20 on speed high hundreds of times, usually with the Fever music. Sometimes I’ve even cleared it with the Chill music! Spoiler—the ending cutscene on high difficulty reveals that the viruses are aliens! I don’t recall a twist like that in Tetris!

Here we are roughly 30 years later, and Nintendo has just released Dr. Mario World in the App Store. It’s still a puzzle game with the goal of annihilating the viruses, but now you only have to match three of a color instead of four to erase it. How quaint. Now I’m the one who feels like an alien in this modern retelling of Dr. Mario’s pharmaceutical adventures.

The game’s fun. Everyone in the HangZone office is in the top tier on versus mode, and I was the 198th person to clear the special stage in World 2.

Financial Performance

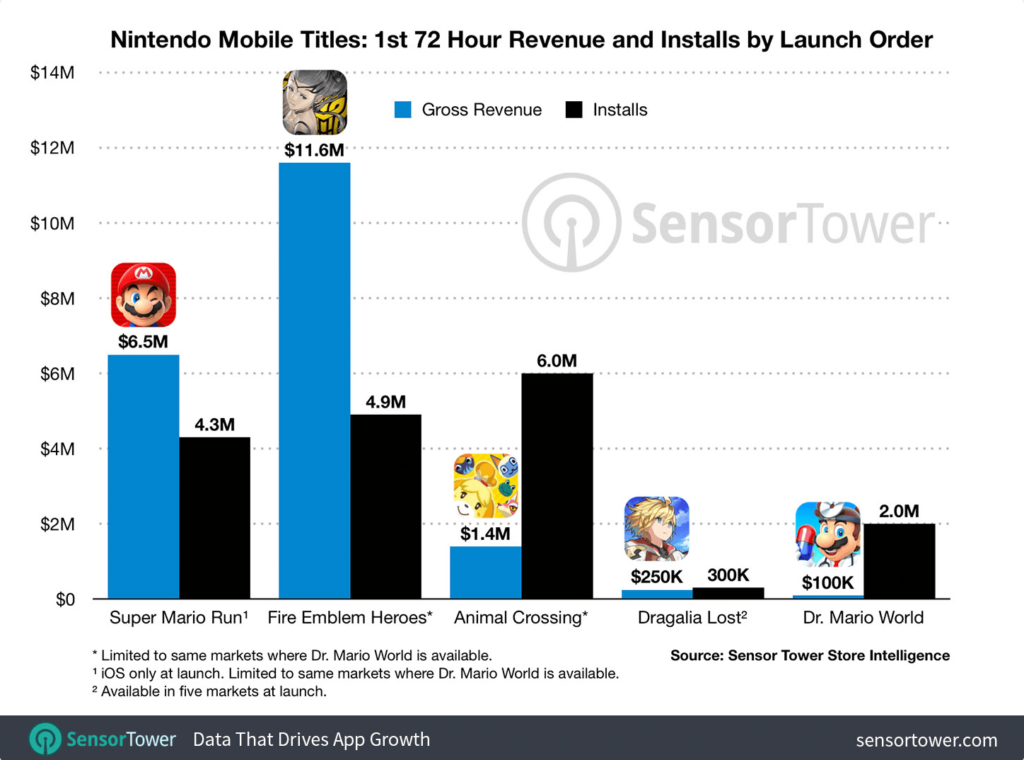

The fun factor is all good and well, but we’re here to talk about revenue. Specifically, let’s consider this chart that Sensor Tower compiled earlier this month. You can see the opening three days of revenue and installs for each of Nintendo’s App Store titles.

On the surface, Dr. Mario World looks like a financial flop, and many news outlets are saying as much based on Sensor Tower’s numbers. I’d like to break things down a little more carefully, and see if we can figure out exactly what the problem is. Let’s consider the different franchises, the varying game styles, and the corresponding financial results.

Super Mario Run

For starters, let’s throw out Super Mario Run from the discussion. It’s effectively a paid game. More specifically, it’s a free game with a one-time paywall after a couple of demo levels. We discussed this monetization model in more detail when the game was released. We know that paid games tend to have a lower upper bound for revenue potential than free games, but the revenue is obviously front-loaded due to the upfront price tag. Consequently, it’s not fair to compare Super Mario Run’s opening three days to Nintendo’s other App Store games which stand to make more money off of users after the initial three days.

Fire Emblem: Heroes

Fire Emblem is a hugely popular franchise in Japan. Fire Emblem: Heroes uses the gacha model that’s found in Puzzle and Dragons and many other top grossing Japanese titles. We’ve discussed the gacha style in the past. Typically, you spend in-game currency to collect random characters for your team. The most desirable characters usually have a 2% chance or less of appearing. You can convert real money to in-game currency to pull more characters. Over time, gacha games will introduce harder content and better characters to keep its players chasing the latest and greatest characters.

Gacha remains arguably the most effective revenue model in gaming. It’s not without its critics, however. Gacha mechanics are heavily regulated in Japan. Europe is actively debating the legality of loot boxes, which are effectively the same mechanic. Many prominent gacha games have shutdown their European servers as a result.

Having said all of this, it’s no surprise that Fire Emblem: Heroes is leading the pack for Nintendo in revenue by a huge margin The combination of a strong franchise and proven revenue model is a recipe for success.

Animal Crossing: Pocket Camp

Animal Crossing already had a history on Nintendo’s own handheld devices. Furthermore, the games already featured doing things with timers, such as growing crops. Sounds like an easy translation to a freemium mobile game, right?

Animal Crossing lets players speed up the timers with in-game currency, similar to Clash of Clans. It’s a proven freemium model. It’s not as effective as top gacha models these days, but it works. Animal Crossing’s revenue has been solid, but not as good as Fire Emblem’s gaudy results. Despite the recognizable brand name in the US, the game still makes most of its revenue in Japan. This is of course true of Fire Emblem and Dragalia Lost as well. Japanese players are now spending up to three times per user compared to the US in many top games, so a recognizable brand in the west may not be as important as you think.

Dragalia Lost

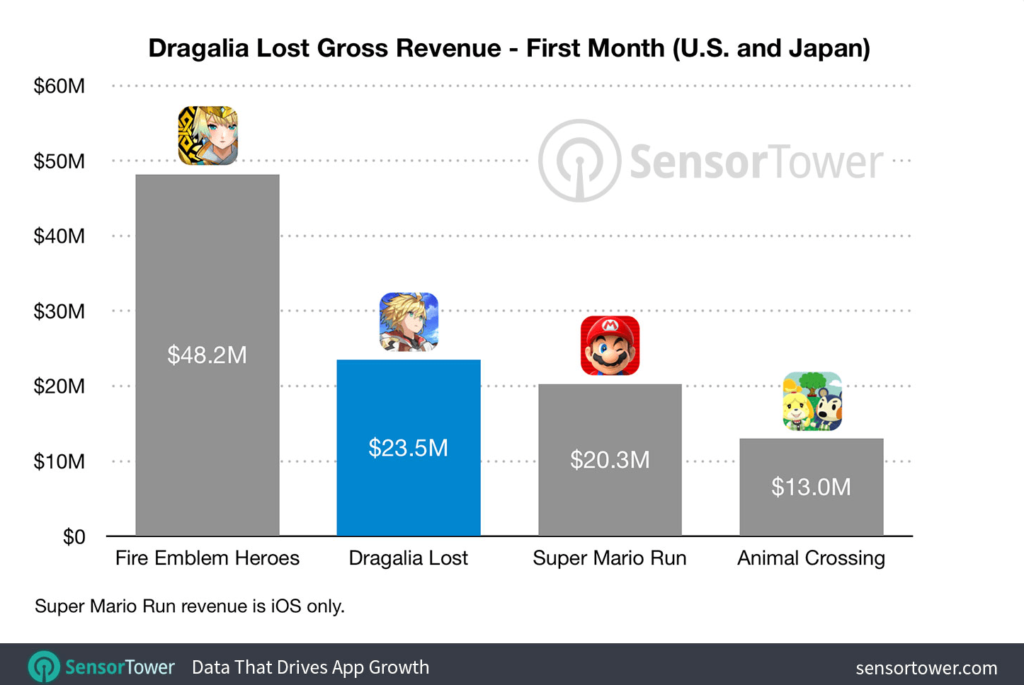

Dragalia Lost is a Japanese style gacha title, but without the name brand of Fire Emblem. It also didn’t launch in as many markets. This makes the lighter revenue and installs understandable. Before you write-off Dragalia Lost as a small-time effort, however, let’s extend our horizon out to one month.

Dragalia Lost finished second only to Fire Emblem in first month revenue among Nintendo’s App Store games. Moreover, it accomplished this feat by making $25 per install, over 4x what Fire Emblem earned during its first month. Fire Emblem has since surpassed Dragalia Lost on revenue per user. Fire Emblem now stands at $38 per user, Dragalia Lost at $33, and Animal Crossing at $3.30 (Sensor Tower). Nevertheless, they’ve performed exceedingly well. Another point for gacha.

Nintendo’s Predicament

After effectively cracking the code to making money in the App Store, Nintendo seemed to be feeling a little sheepish about making so much money. I’ve been a fan of Nintendo since the NES in the 1980s. They’ve consistently put out high quality content. They’ve created several great franchises. Nintendo has more goodwill than any game developer. Freemium titles often turn off traditional gamers, so the company has reason to tread carefully and not agitate its loyal console customer base. They’ve gone so far as to suggest in their earnings call and other interviews that they don’t want gamers to spend too much money on in-app purchases in their mobile games (Wall Street Journal).

This puts Nintendo in an odd sort of connundrum. They know how to print money on mobile, but they don’t want to do it at the expense of long-term profits and goodwill. So what do you do?

Dr. Mario World Revenue Model

How about a different flavor of freemium! Dr. Mario World’s revenue model looks like Candy Crush at first glance. You have five hearts. You use one to play each level, and get one back on your first clear. This allows you to keep going as long as you’re winning. If you run out of hearts, you can buy more. You can also use items in levels, which cost in-game money. This is the typical revenue model for a casual match 3 game.

In an interesting twist, they added a gacha element. You can get different doctors and assistants that have different abilities. Some are more useful for single player, while others are good for versus. Drawing multiples levels them up. Typical gacha.

Casual Gacha

Well, it’s typical gacha as far as rates go, but the problem is that there isn’t as much depth as other gacha titles. There are only 10 doctors and 32 assistants. Many of the assistants’ skills are the same. For the sake of comparison, my favorite gacha game, Puzzle and Dragons, has thousands of characters. Puzzle and Dragons teams have to be carefully assembled to handle all of the dungeon mechanics. In Dr. Mario World, the characters’ abilities aren’t as important for success. My characters’ skills typically don’t have a dramatic impact on whether I complete a level or not. The choice of doctor is important for versus mode, due to substantial match-up advantages (i.e. Toadette crushes Bowser, but struggles against Peach due to her block stat against the #3 attack). However, there’s no way to know which character you’ll play against. Even if I leveled up my characters more, those match-up advantages are so exaggerated that it probably won’t help me much, other than ditto matches without the match-up advantages. This all makes the gacha element less exciting to roll than in other games.

Furthermore, I think the Candy Crush style monetization elements turn off more serious players. The target audience for American casual match 3 games is women over 40. The target audience for Japanese gacha games skews toward the more traditional core gamer. This audience is used to games that don’t have monetization efforts outside of the gacha and stamina refresh. I think the items in Dr. Mario World may serve to cheapen the experience in some players’ minds.

Finally, Dr. Mario isn’t the same caliber of franchise as Fire Emblem. It may be more well known in the US, but when the big revenue is coming out of Japan on mobile, that’s of little consequence.

Final Thoughts

While these download and revenue figures don’t look very compelling for Dr Mario World, Sensor Tower notes that it’s actually roughly in-line with King.com’s recent match 3 titles. On the one hand, you can consider that solid news. Nintendo delivered a match 3 variant that’s doing as well as the traditional western leader in match 3 games. On the other hand, I’m more inclined to wonder if we’re in the latter days of the casual match 3 era. When Activision bought King.com, they paid a much lower P/E ratio than the average multiple for the S&P 500. The takeout price didn’t suggest the rosiest outlook for growth prospects. It seems that the mobile gaming world has indeed moved on to new things.

For what it’s worth, I think Dr. Mario World is a really unique and fun twist on match 3. It’s not the single move gameplay people think of with Candy Crush. We know complex match 3 with gacha works—prime example being Puzzle and Dragons. If Nintendo really wanted to maximize revenue, they could have focused more on the gacha, possibly scratched the items, and deepened the character complexity. Of course, we also know Nintendo’s primary goal is not to maximize revenue in the App Store. One of Activision’s goals with the King.com acquisition was to convert casual match 3 gamers over to its console titles. Maybe Nintendo also wanted to reach out to the casual crowd with Dr. Mario World and intentionally refrained from using lucrative complexity that might thwart this effort. It’s too early to say for sure, or judge it as a success or failure. We’ll just have to wait and see. Until then, thanks for reading the HangZone blog.